The Central Bank of Kenya (CBK) recently published its annual report for the fiscal year 2023/2024, providing a comprehensive look into Kenya’s economic performance and the bank’s strategic initiatives. The Central Bank of Kenya 2024 Financial Report is a loaded with information for anyone interested in understanding the Kenyan economy and the bank’s role in shaping its future. We take a closer look at some of the key takeaways from this report, focusing on key economic growth metrics.

Improvements in Central Bank of Kenya 2024 Financial year Report

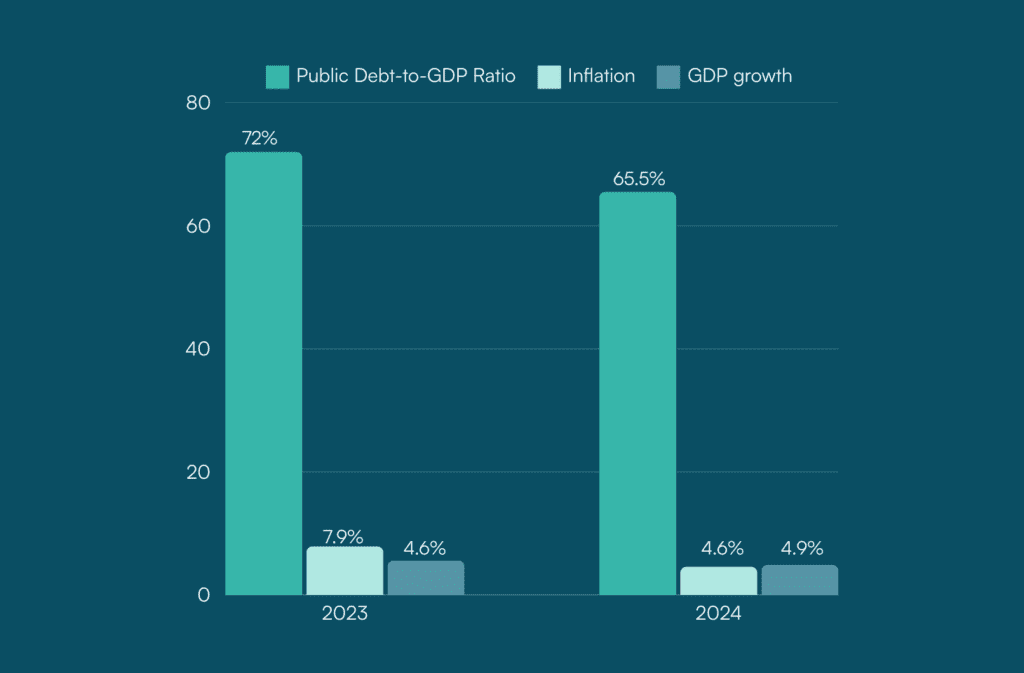

- Public Debt-to-GDP Ratio: The ratio of public debt to GDP decreased from 72.0% in June 2023 to 65.5% in June 2024. This improvement was attributed to an increase in domestic debt, which grew by 12.0%, and a decrease in external debt, which declined by 5.4%.

- Inflation: Overall inflation declined from 7.9% in June 2023 to 4.6% in June 2024. This easing of inflation was driven by decreases in the prices of select food and fuel items, bringing it back within the target band of 5±2.5%.

- Official Forex Reserves: The official forex reserves remained adequate, indicating the CBK’s ability to manage external shocks and maintain stability.

- Economic Resilience: The Kenyan economy continued to show resilience, with real GDP growth of 5.6% in 2023, supported by strong performance in the agricultural and services sectors.

- Lending Rate: The average lending rate increased, aligning with the monetary policy stance and higher domestic borrowing. This suggests effective monetary policy transmission and a responsive financial sector.

- Kenya’s real GDP growth in 2023 was 5.6%, a significant improvement from the 4.9% growth in 2022.

- The agricultural sector grew by 6.5% in 2023, compared to a contraction of 1.5% in 2022.

- The services sector grew by 7.0% in 2023, driven by strong performance in finance and insurance, transport and storage, real estate, information and communication, and accommodation and food services.

- Inflation remained within the target range of 5±2.5%, averaging 6.23% during the financial year.

Declines in Central Bank of Kenya 2024 Financial Report

- Average time to maturity for bonds: It decreased from 8.5 years in June 2023 to 7.5 years in April 2024. This decline was driven by market preference for short-dated instruments amid an elevated interest rate environment. The government’s consistent issuance strategy, including reopening medium-term Treasury bonds, contributed to this trend.

- Current Account Balance: The current account deficit narrowed to USD 4,091 million (3.7% of GDP) in FY 2023/24, compared to USD 4,841 million (4.2% of GDP) in FY 2022/23. This was due to an improvement in the goods balance and secondary income balance, which offset the worsening services balance and primary income balance.

- Domestic Credit Growth: Annual growth in domestic credit decreased to 6.0% in FY 2023/24 from 12.2% in FY 2022/23. This decline was primarily due to a decrease in lending to the private sector, partially attributed to exchange rate valuation effects on foreign currency-denominated loans.

- Exchange Rate: The Kenyan shilling weakened by 14.1% against the US dollar during the fiscal year, although it appreciated by 17.5% in the second half of the year. This initial weakening was influenced by global developments, including monetary policy tightening in advanced economies.

What This Means for Businesses in Kenya

- The strong growth in the agricultural sector indicates opportunities for businesses involved in the production, processing, and distribution of agricultural products.

- The performance in the services sector highlights potential areas for investment and expansion, particularly in finance, insurance, tourism, and information technology.

- Maintaining inflation within the target range provides a stable environment for businesses to operate and make long-term investment decisions.

CBK’s Role in Financial Stability: Addressing Fraud and Compliance

CBK’s Initiatives

- The CBK has taken proactive steps to address fraud and compliance issues, including the issuance of the Kenya Foreign Exchange Code for commercial banks.

- It has focused on enhancing its oversight of Money Laundering, Terrorism Financing, and Proliferation Financing (ML/TF/PF).

- The CBK has also undertaken several initiatives to enhance its risk management framework, including the automation of various processes and the strengthening of its control environment.

Explore Prembly AML and KYC solutions, book a call with one of our KYC and AML experts.

Focus on Due Diligence

CBK’s Actions

- The CBK has been actively involved in the licensing and supervision of authorized dealers, digital credit providers, and mortgage refinance companies, conducting thorough due diligence.

- The bank has also emphasized the importance of customer due diligence and enhanced its risk management framework.

Looking Ahead

The CBK’s 2023/2024 annual report showcases the bank’s commitment to maintaining economic stability. The report addresses the importance of enhancing due diligence for fraud prevention and compliance. The CBK’s proactive measures and strategic initiatives will be crucial in supporting sustainable economic growth and safeguarding the integrity of the financial system as Kenya adapts to a complex global landscape.

Read more about Fraud Prevention with Prembly Fraud Prevention tools.

Get a customized solution here.